In For the Long Run?

Randy Koehler,

Certified Financial Planner

Registered Investment

Advisor Associate

I know people like

Warren Buffet have been telling you that the

market averages about 10%, and

if you stay in it for the “long-run”,

you will be rewarded. The devil is in

the details. Just exactly how long is the “long-run” anyway? The definition

of “long-run” according to Ibbotson, the company Wall Street turns to for

historical data on the S&P 500, is about 80 years. Whenever you see the

charts that reflect the 10% average return on the S&P 500, usually the

beginning date for the chart is either 1925 or 1926. Not exactly consistent

with the time horizon that a typical retiree might use to project income for

the remainder of their life. In fact, at 70 years of age, your remaining

life expectancy is 16 years. Not quite the 80 years the charts use to

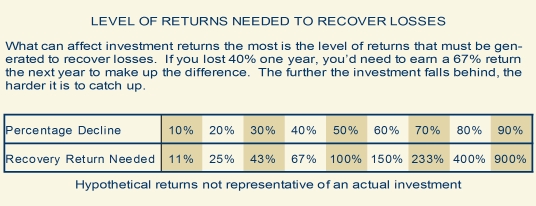

illustrate the concept. If you don’t have 80 years, the S&P 500 doesn’t

always average 10%. In fact, on more than one occasion it would have taken

more than 10 years just to break even on your initial investment in the S&P

500! Not to mention the countless number of people who are still trying to

recover their losses from the 2000-2002 and 2008 stock market crash.

Did Your Broker or Advisor Call You?

Many of you were never contacted by your broker or advisor to adjust your portfolio during the 2000 to 2002 market downturn, and during the current market upheavals which continue into today. If you had contact with your broker or advisor, it was probably you who initiated the contact. Koehler Financial Services, Inc. uses a “hands on” approach, we review your account daily and make tactical profit taking adjustments as needed. We re-allocate yearly according to our proven disciplined investment formulas, and use asset preservation strategies during turbulent times.